Key highlights

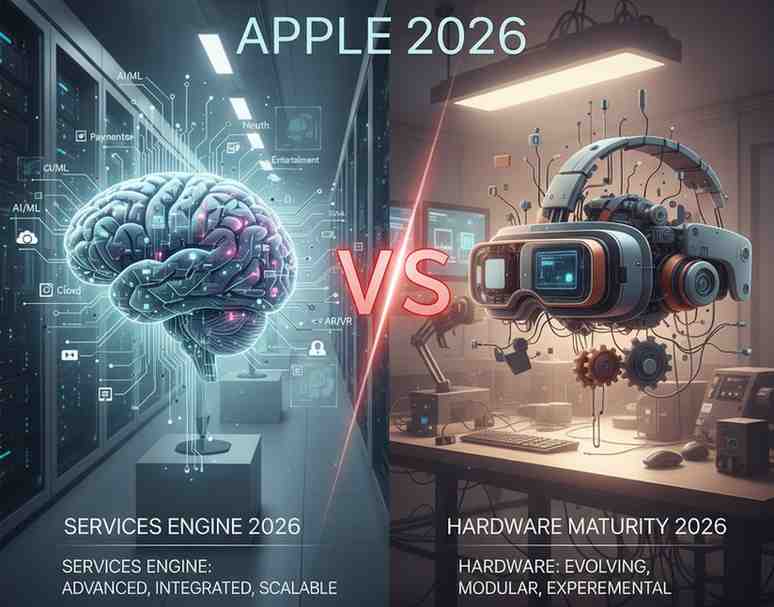

- Apple’s growth tension is simple: hardware is cyclical, but Services scales with the installed base. SEC

- Services is already a massive line item (Apple reports Services net sales alongside Products). SEC

- 2026 risk: regulatory and platform-rule pressure can squeeze “take rates” and distribution advantages.

What changed: Apple isn’t only a device company anymore

Apple’s own financial statements show Products and Services as two major buckets of net sales. In FY2024, Apple reported Products net sales of $294,866M and Services net sales of $96,169M. SEC

That’s the heart of the 2026 story: even if iPhone upgrades slow, Services can keep compounding—if Apple can defend distribution and pricing.

The 2026 growth map (the realistic one)

Hardware maturity means:

- Growth is driven by replacement cycles, mix (Pro models), and regional demand.

- Supply-chain and macro softness can hit quarters quickly.

Services engine means:

- More active devices → more subscriptions, payments, and platform spending.

- Monetization is smoother—unless rules change.

What “Services growth” depends on in 2026

1) Installed base behavior: Are users paying more per device over time?

2) Platform economics: App Store/search distribution/payment rails face policy pressure in multiple jurisdictions.

3) Content and cloud costs: Services margin isn’t “free money”—it has costs.

Small question people search: “Does Services mean Apple is recession-proof?”

No. It’s more resilient than hardware, but Services still depends on consumer and developer spending—and on Apple’s ability to keep platform economics stable.

The scoreboard that matters in 2026

- Services share of total net sales and margin durability SEC

- Hardware replacement stability (no deep demand cliffs)

- Regulatory outcomes that could alter platform monetization

Leave a Reply