New Delhi, February 2026 — India’s trade balance has taken an unexpected hit as a massive surge in gold and silver imports sent the merchandise trade deficit spiraling. While the government had hoped for a stabilizing trend, January’s data reveals a widening gap that has caught markets and economists off guard, highlighting India’s persistent hunger for precious metals even amid shifting global alliances.

A Golden Spike in the Import Bill

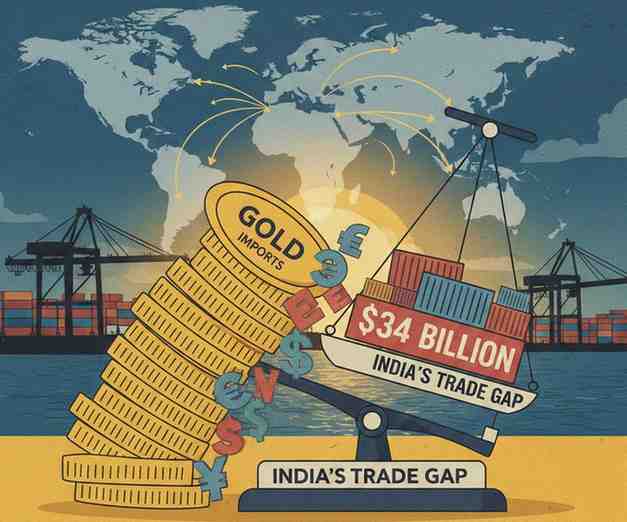

In January, the merchandise trade deficit widened sharply to $34.68 billion, a significant jump from the $25.4 billion recorded in December. This figure was far higher than the $26 billion projected by a Reuters poll of economists.

The culprit? A massive spike in imports, particularly gold and silver, which pushed total merchandise imports to $71.24 billion. While these metals are often seen as a hedge against global uncertainty, their arrival in bulk has significantly tilted the scales, leaving policymakers to manage a deficit that grew by nearly $9 billion in a single month.

Export Friction and the Merchandise Dip

While imports soared, India’s merchandise exports faced a cooling period, slipping to $36.56 billion from $38.51 billion in December. Key sectors like engineering goods, petroleum products, and iron ore showed growth during the fiscal year, but they weren’t enough to offset the import bill.

Despite this merchandise slump, the services sector remains India’s economic armor. The services trade surplus reached $180.58 billion for the April-to-January period, driven by strong growth in tech and professional services. This surplus continues to act as the primary buffer, preventing the widening merchandise gap from turning into a full-scale balance-of-payments crisis.

The “Trump Relief” and the Oil Pivot

One of the most significant shifts in January was the easing of trade tensions with the United States. Following an announcement by U.S. President Donald Trump, tariffs on Indian exports are set to drop from a staggering 50% down to 18%.

This relief comes with a strategic geopolitical trade-off. As part of a new framework with Washington, India has agreed to reduce its reliance on Russian oil, pivoting instead toward significantly expanded energy imports from the United States. This realignment is expected to stabilize trade relations with the U.S. and potentially lower the tariff burden even further once a formal India-U.S. trade agreement is signed.

New Horizons: The EU Trade Pact

Beyond the U.S., India is looking toward the European Union for long-term stability. A recently signed trade pact with the EU is expected to come into force within the next year. For Indian exporters, this represents a massive opportunity to diversify away from traditional hubs and tap into high-value European markets, potentially rebalancing the trade equation that is currently skewed by precious metal inflows.

Bottom Line

India’s January trade report is a tale of two economies: a services sector that is booming and a merchandise sector struggling under the weight of gold imports. While the widening $34 billion deficit is a warning sign, the combination of U.S. tariff relief and upcoming EU trade deals offers a roadmap for recovery. For now, the “Gold Fever” remains the biggest variable in India’s economic ledger.

Leave a Reply