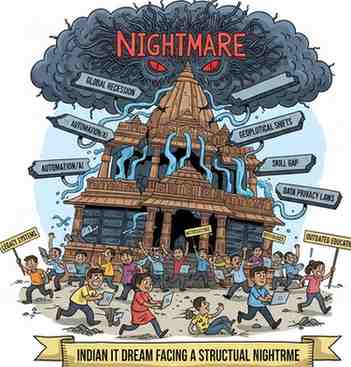

New Delhi, February 2026 — The decades-long “Golden Age” of Indian IT is facing its most brutal reality check yet. A massive sell-off has wiped billions in market value as the industry grapples with a terrifying realization: Artificial Intelligence isn’t just a new tool; it’s a wrecking ball aimed at the traditional outsourcing model.

What was once a steady climb for giants like TCS and Infosys has turned into a “bloodbath,” with the Nifty IT index crashing 12% in just three sessions this week.

The Death of the “Man-Hour” Model

For twenty years, India’s IT success was built on a simple formula: hiring lakhs of engineers to perform tasks for global clients. AI has just broken that formula.

New developments in AI systems—specifically Claude and Google’s latest upgrades—can now handle legal research, drafting, sales marketing, and complex data analysis. These are the exact “bread and butter” services that Indian SaaS (Software as a Service) companies used to charge millions for.

Industry experts warn that the era of “headcount-based” revenue is dying. Clients are no longer willing to pay for 100 engineers when an AI plugin can do the same work in a fraction of the time.

A Ghost Town for New Graduates

The employment numbers tell a chilling story of a sector in retreat. In the last year, India’s top tech firms added a net total of just 17 jobs.

- Hiring Freeze: Roles vacated by employees are no longer being filled.

- Automation Displacement: Routine-heavy roles are being phased out as AI automates repetitive tasks.

- Outcome-Based Pricing: Clients are shifting away from paying for “time spent” and are now only paying for “results delivered,” further squeezing profit margins.

While 2025 saw significant layoffs at firms like TCS, analysts at Geojit Financial Services suggest this is only the beginning. The “structural shift” means fewer humans are needed to deliver the same outcomes.

The “SaaS” Bubble Bursts

The panic isn’t just about jobs; it’s about the survival of the business model itself. Investors are losing confidence in traditional SaaS companies as AI-native startups begin to offer the same capabilities without the heavy subscription fees.

The market decline isn’t just “sentiment”—it’s a fundamental re-evaluation of value. JPMorgan recently cited AI plugins as a direct threat to the dominance of traditional IT services, sparking the massive sell-off seen this week.

The Bottom Line

For years, IT was the safe haven for Indian talent and investors. But as AI develops more in a single week than it used to in a year, the industry is entering a period of forced evolution. The “Golden Years” of 2003–2008 are officially over; in this new era, the companies that cannot outpace the AI they helped build may simply cease to exist.

Leave a Reply