In a market landscape often clouded by high-octane headlines and “budget fever,” Kalpen Parekh, Managing Director and CEO of DSP Mutual Fund, has issued a grounded wake-up call to Indian investors. His message is clear: the current phase of market consolidation is not a reason for fear, but a rare window to secure financial stability for the next ten years.

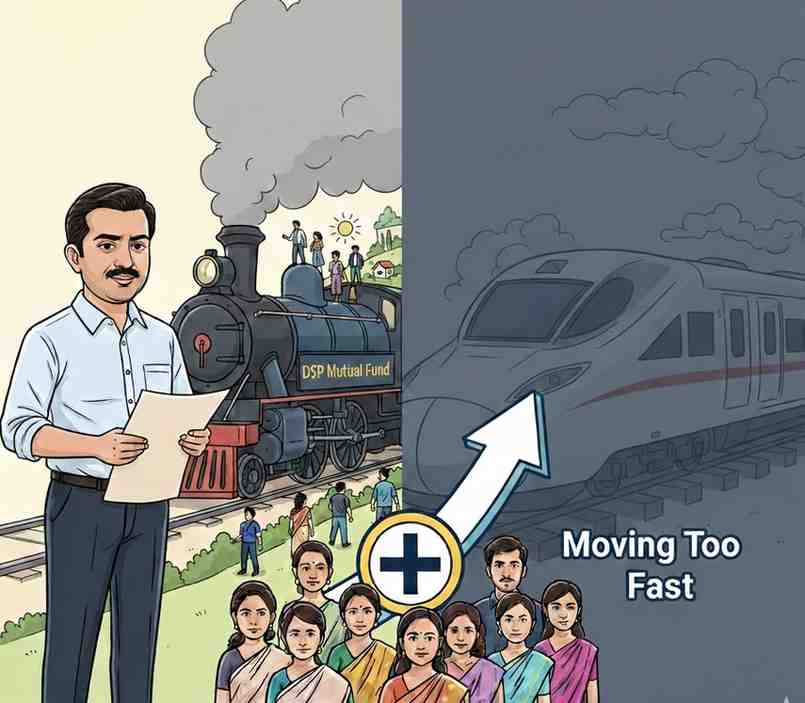

The “Stationary Train” vs. the “Mumbai Dash”

Parekh uses a vivid Mumbai analogy to describe market timing. Most investors, driven by FOMO (Fear Of Missing Out), try to “jump onto” a fast-moving train—buying when markets are peaking—which risks their financial lives.

“The best time to get into a train is when it is stopping at the station,” Parekh told Mint. He argues that the current “slowing phase” allows investors to acquire assets and units without the life-threatening risks of a vertical bull run. For those willing to invest gradually over the next 24 months, the rewards could span a decade.

The “Budget Noise” Trap

While analysts obsess over every line of the Union Budget, Parekh—who has seen 30 budgets since 1998—dismisses the event’s long-term impact on personal wealth. He describes the budget as a mere “annual accounting exercise” of the government.

Despite the yearly hype, Indian markets have historically compounded at 13-14%. Parekh’s advice is blunt: stop treating the budget like a life-altering event. Your 20-year financial goals have almost no connection to a single year’s fiscal policy.

The Illusion of Gold and Silver

Addressing the recent frenzy in precious metals, Parekh warned that “what is popular is rarely profitable.” While DSP’s silver fund saw a staggering 500% rise over three years, he cautioned that investing now is often a classic retail mistake.

Unlike stocks, gold and silver have no cash flows. Parekh revealed his own “trimming” strategy, cutting back on gold mining exposures after they tripled, and urged investors to use multi-asset funds rather than chasing metal prices at historic highs.

The Reality of “Real Returns”

With Indian inflation cooling to 4%, Parekh highlights a hidden opportunity in fixed income. While 13% equity returns were common when inflation was 8%, a 10% return in a 4% inflation environment offers the same “real” wealth. Bonds currently earning 7% provide a solid 3% real rate of return—a metric investors often ignore in favor of “big numbers.”

Bottom Line

The era of “blindly paying for growth” is shifting toward a phase of prudence. Parekh’s personal portfolio—60% growth equity, 25% bonds, and 15% gold—serves as a template for the modern investor. By ignoring the “news sugar” and focusing on asset allocation, the next two years could be the most productive period for your portfolio since the 2008-2013 consolidation.

Leave a Reply