Key highlights

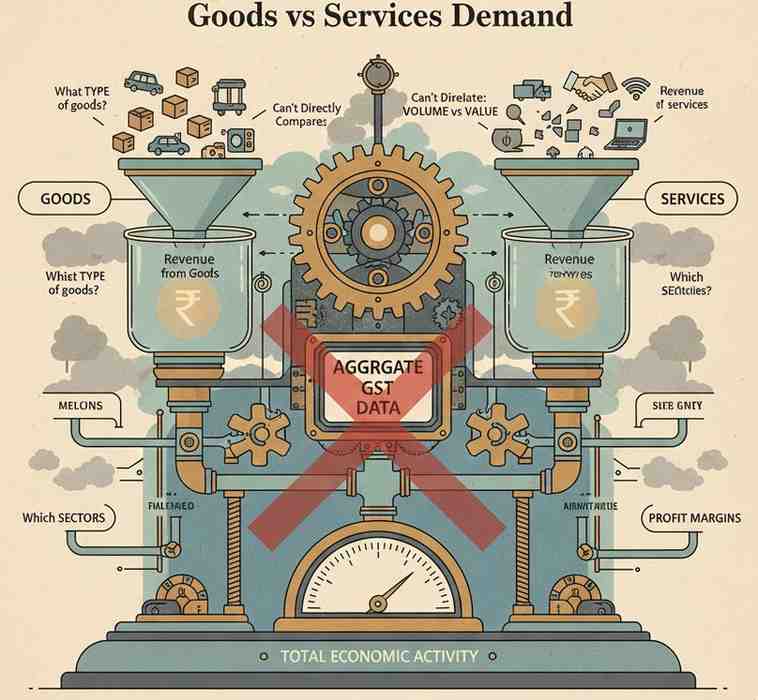

- The GST release provides component splits (CGST/SGST/IGST/Cess), not a direct “goods vs services scoreboard.” Press Information Bureau+1

- Domestic gross GST was reported at ₹1,45,052 crore (Oct 2025), up from ₹1,42,251 crore (Oct 2024). Press Information Bureau

- 2026 editorial rule: interpret signals, avoid declaring booms.

If 2026 has one predictable problem, it’s this: we will see one big number and try to squeeze a whole economy out of it. GST tempts that mistake because it’s monthly, headline-friendly, and official.

October 2025’s GST release gives the macro pulse and the structural breakdown—CGST, SGST, IGST, and Cess—enough to describe direction, not enough to crown a sector. Press Information Bureau+1 The factsheet also provides a domestic collection reference: ₹1,45,052 crore in Oct 2025 vs ₹1,42,251 crore in Oct 2024. Press Information Bureau

In January 2026, the correct way to read this is modestly intelligent. CGST/SGST often reflect domestic turnover patterns; IGST can carry cross-border/import-related movements. But none of these is a clean proxy for “goods are booming” or “services are dominating.” Goods and services are interlocked across value chains, and GST captures the invoice world—formal, recorded, and sensitive to compliance behaviour.

So what should a 2026 article responsibly say? That festive-month collections were firm, that domestic turnover signals did not weaken visibly, and that component splits can hint at where activity was concentrated—but do not prove a sectoral takeover.

The disciplined conclusion is almost boring—and that’s why it’s trustworthy: GST can support a narrative of resilience; it cannot alone deliver a sectoral verdict.

Leave a Reply