Key Highlights In 2026, ITC is not just a tax concept—it’s your working capital engine. But the rulebook is no longer only “keep invoice and claim credit.” The system ecosystem (GSTR-2B, IMS actions, mismatch intimations) is increasingly decisive. GST Tutorial+1 Why ITC equals cash flowEvery rupee of eligible ITC reduces the cash you must pay out...

Category: Economy

The “Sticky Inflation” Story: Why Trendlines Matter More Than One Month’s Headline

Key highlights There is a reason serious analysts distrust single-month drama: inflation is a series. CPI’s real value is not the headline you publish today—it is the trend you can defend tomorrow. The official CPI portal and MoSPI’s CPI materials provide access points (press releases, annexures, and structured data) that let readers trace inflation’s behaviour...

Amazon 2026: Retail margin reality vs cloud profitability

Key highlights The Amazon model in one line Amazon is a retail/logistics empire with a high-margin engine (AWS) and a growing monetization layer (ads, Prime economics). The financials make the mix visible. Follow the operating income: it tells you who pays for what Amazon reports segment operating income (loss). In 2024: That’s the core: AWS...

Dollar Dominance 2026: Is “De-dollarization” Real or Just a Headline?

Key highlights What the official data actually shows Two clean lenses: If a currency is the “plumbing” for transactions and hedging, it stays dominant even if trade invoicing shifts a little. Why dominance persists: the boring reasons that matter This isn’t ideology. It’s operational convenience. What “real de-dollarization” would look like People ask:“If countries want...

Budget Session 2026 Watchlist: Will the Speaker Call an All-Party Meeting — and Why It Matters

Key highlights In Parliament, the first real story of the Budget Session often begins before the gavel hits the desk: leaders meet, tempers are measured, and red lines are quietly exchanged. The claim that Lok Sabha Speaker Om Birla will hold an all-party meeting on January 21, 2026 reads plausible—but as of December 26, 2025, there’s no official public confirmation...

Global Interest Rates 2026: Who Blinks First—Fed, ECB, or Emerging Markets?

Key highlights Fed 2026: what would force the first blink? From the Fed’s own policy statements, the committee frames decisions around inflation progress and the balance of risks. Federal ReserveSo a “blink” typically requires: ECB 2026: the European constraint The ECB’s communications and projections highlight inflation and growth dynamics into 2026. European Central BankEurope’s problem is often:...

BYD’s Global Expansion 2026: How China’s EV Giant Is Taking Over New Markets

Key highlights BYD’s edge has always been structural: it behaves like a vertically integrated industrial system more than a typical automaker. In 2026, that matters because EV competition is becoming a supply-chain war disguised as a showroom war. The expansion engine: why BYD travels well 1) Battery gravityIf you control key components, you can price...

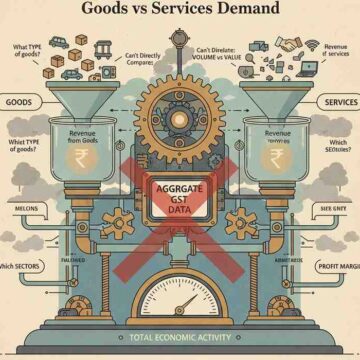

2026 Without the Overclaim: What GST Can (and Can’t) Reveal About Goods vs Services Demand

Key highlights If 2026 has one predictable problem, it’s this: we will see one big number and try to squeeze a whole economy out of it. GST tempts that mistake because it’s monthly, headline-friendly, and official. October 2025’s GST release gives the macro pulse and the structural breakdown—CGST, SGST, IGST, and Cess—enough to describe direction,...

GST Council in January 2026? What to Watch on Rate Changes After the Big 2025 Rationalisation

Key highlights People keep searching “GST rate cut 2026” the way they search cricket scores—hoping for relief. The truth is: a lot of the heavy lifting was already signalled in 2025. Official material around the 56th meeting describes a simplified two-slab direction (5% and 18%), and wide relief across many common-use items, along with a higher...

Economic Survey, Simplified for 2026: What It Is—and What It Isn’t (So Readers Stop Treating It Like the Budget)

Key highlights January is Budget-season air. And every year, the same confusion returns: people read the Economic Survey expecting direct policy changes. The Survey isn’t a rates document. It’s a narrative instrument—how the state explains the economy to itself and to the public. On the India Budget portal, the Survey is presented as an organised...